This issue is part of a thread related to strategy—a draft of ideas using several concepts and models to facilitate a discussion at a higher level.

Let me introduce something new in the Brazilian clubs’ strategy efforts:

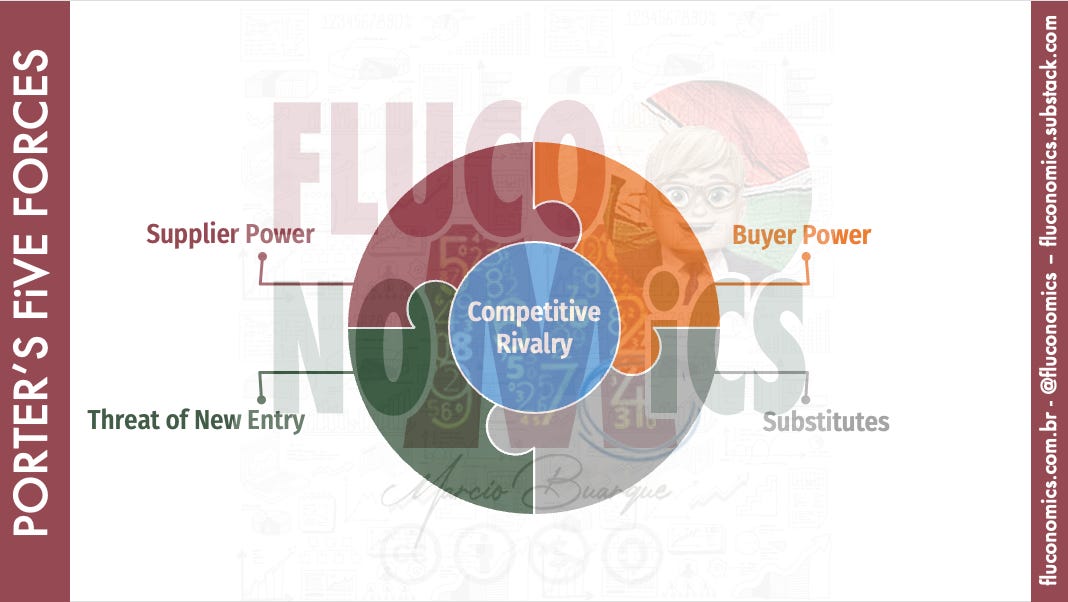

PORTER’S FiVE FORCES MODEL

Continuing the thread on strategy, today we will address the five forces model developed by Michael E. Porter.

Porter’s Five Forces is a strategic model that identifies and analyzes five competitive forces that shape every industry, providing insights that will help us determine an industry’s weaknesses and strengths. This model can be applied to any segment of the economy to understand the level of competition within the industry and enhance a business’s long-term profitability.

Did we do the same using the SWOT analysis? Not really.

As we see in the last issue, SWOT examines an organization’s internal (strengths and weaknesses) and external (opportunities and threats) forces to assess its inner potential. Porter’s Five Forces are all focused on external factors.

While they help assess a business’s strengths and weaknesses, a primary difference is that SWOT focuses more on company-specific elements. At the same time, Five Forces involves a look at five critical competitive factors when making a strategic decision.

Five Forces seems more significant than SWOT in the Football industry, thinking about strategic plans, due to (i) all businesses are inserted with a rigid regulatory framework; (ii) there are significant revenues gaps in the industry, locally and externally; (iii) unfair competition; (iv) competitors have a different level of attractiveness.

It doesn’t make much sense to make a strategic plan by navel-gazing. As much as the SWOT matrix brings external elements, analyzing the environment in which the business is inserted is very shallow compared to Porter’s five forces model.

Each action planned internally will suffer multiple external reactions, some far beyond acceptable practices.

And why are efforts not identified to evaluate and plan using Porter’s model? The famous amateurism of associative models. People usually fall short of the technical challenges required for capable and modern management. People who do not hold a management position do not have proper training or experience in management, planning, and control and are magically elevated to the C-level through these triennial elections.

In this issue, the Five Forces analysis will be used to identify a football industry’s structure to help us to determine a single corporate strategy.

THE FiVE FORCES

Porter’s Five forces are:

- Competition in the industry (competitive rivalry)

- Effects of new entrants into the industry (threats)

- Power of suppliers

- Power of customers

- The threat of substitute products

COMPETiTiON iN THE iNDUSTRY

The first of the Five Forces of the model refers to the industry’s competition, precisely the number of competitors and their ability to disrupt your business.

They may have more market share and, therefore, more economic power; they can strongly influence regulators or even have beneficial and quasi-symbiotic relationships with key vendors and service providers in the industry under review.

In theory, according to the model, the greater the number of competitors, the lower the individual power of a company. However, in the case of football, it is tricky and requires some adaptation, as we will see below.

The model also argues that suppliers and buyers use competition to offer businesses better or lower prices. Another situation in football requires adjustment in the analysis. The model further says that if competitive rivalry is low, the company has greater power to charge higher prices and set the terms of the deal, maximizing its return through higher sales and profits.

At this point, it becomes clear how the football industry is very peculiar and requires numerous adaptations to formulate strategic and operational plans in the light of good management. Standard copy and paste never work in football.

Despite having a considerable number of clubs, it is prevalent that the competition is restricted to a few. An elite dominates football on a national level, and some supreme elite dominates it on a continental level, at least in terms of sporting performance and revenue generation.

The regulatory framework and the submission of this elite to different levels of federations seek to bring some balance to this game of forces. Still, it is undeniable that the elite mentioned above exerts much more influence than the other players.

THREAT OF NEW ENTRY

The power game is also affected by the impact of new entrants in the market where the business to be analyzed is inserted.

According to the model, the less time and money it costs for a competitor to enter the analyzed market and become an effective competitor, the more the position of an established business can be significantly altered.

Again we have peculiarities in football.

A new entrant has two paths: a long one, creating a team from scratch and starting from scratch, or buying an existing team, in different divisions, with varying time perspectives to become an effective competitor.

The theory still says that a segment with solid barriers to entry is ideal for existing companies, as they could charge higher prices and negotiate better terms. Yet another situation that requires adaptation is the football industry.

There are no natural barriers to new entrants to this industry. However, there are financial fair play mechanisms that can emulate these barriers.

POWER OF SUPPLY

Let’s move on to the third component of Porter’s Five Forces model.

It deals with how suppliers can increase the cost of inputs exceptionally quickly. The model understands that this is inversely proportional to the number of suppliers of critical information of a good or service, that is, how unique and rare these inputs are and how much it would cost a business to switch to another supplier. So, the fewer suppliers for the industry, the greater the dependence on that supplier.

As a result, the supplier has more bargaining power, and it is effortless to seek other advantages in the trade. On the other hand, when there are many suppliers or low switching costs between rival suppliers, a company can keep its input costs lower and increase its profits.

How to adapt all this to football?

On the operational side, day-by-day routine, perhaps the model can be applied without further adjustments, but let’s consider the relationship between clubs, agents, and athletes with potential.

The relationship observes what the model describes; the rarer, the more powerful, to the point of establishing an abusive relationship, excluding any other illicit negotiation that may occur.

It’s a very peculiar situation. The power of these suppliers and their weight in the strategic assessment is enormous.

POWER OF CUSTOMERS

The fourth external force to be studied refers to the ability of customers to reduce prices (revenues generated), as well as whether their power level can be one of the Five Forces.

The model argues that this force can be affected in a few ways: (i) how many buyers or customers a company has, (ii) how significant each customer is, and (iii) how much it would cost a business to find new customers or markets for its products.

Thus, the model understands that a smaller and more influential customer base means that each customer has more power to negotiate lower prices and better deals. A company with many more minor, independent customers will find it easier to charge higher fees to increase profitability.

In this fourth force, we will have arduous work to apply the model. Here, factors such as the electoral power of fans, the electoral power of non-fans using the associative model, and the passionate side of the business come into play.

The castes that derive from the existence of the associative model will make us have a base of millions of fans, with a tiny portion with much more power than it should have.

In addition, the growth of the base of supporters who contribute and generate revenue is associated with subsidies, challenging the thesis that the larger the base, the greater the bargaining power of the business (football club).

SUBSTiTUTES

This Issue is almost over!

The last of the Five Forces to be addressed concerns substitutes.

Substitute goods or services that can be used in place of a company’s products or services pose a threat. Here it will be necessary to see the football industry as part of a big entertainment business.

The model argues that businesses that produce goods or services without close substitutes will have more power to raise prices and secure favorable terms. But that doesn’t uniformly apply to the football industry.

The niche of fans who live 24/7 at their clubs is a minority, so most of the target audience is subject to the elements of multiple entertainment options, sports or not, apart from the fickle fans. They exist, change beloved teams, and only support punctually if the subject is in evidence.

If substitutes are available, customers will have the option to stop consuming football, and the power of a club can be weakened.

NEXT iSSUE

The next Issue (#67) will apply everything written so far to outline once again what would be the insertion of Fluminense within the football industry. It is part of the effort to elevate the debate, thinking outside the box strategically and fundamentally. However, its release will take place at the height of the electoral debate.

Due to the theme’s originality and my aversion to the electoral debate, the edition will be restricted.

Subscribe to the newsletter and get in touch via Twitter, or use the feedback section at this Issue’s end. At least ten subscribers will be chosen to receive Issue 67 free of charge.

PLEASE SUPPORT FLUCONOMiCS

If you are still not sure if you want to subscribe and become a member of the newsletter, please consider contributing to this initiative from time to time by clicking here or here.